Factory Overhead Is 75 of the Cost of Direct Labor

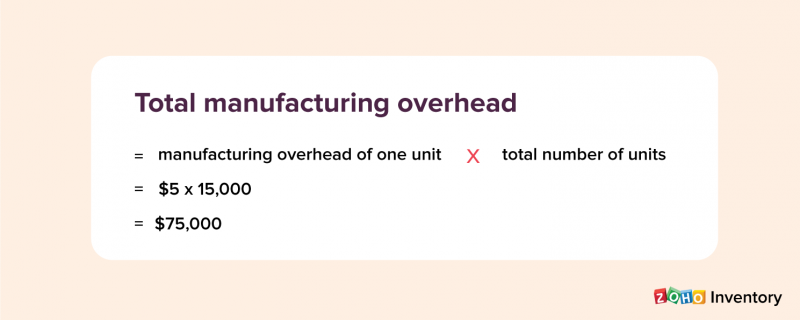

Predetermined overhead rate is used to apply manufacturing overhead to products or job orders and is usually computed at the beginning of each period by dividing the estimated manufacturing overhead cost by an allocation base also known as activity base or activity driver. Commonly used allocation bases are direct labor hours direct labor dollars machine hours.

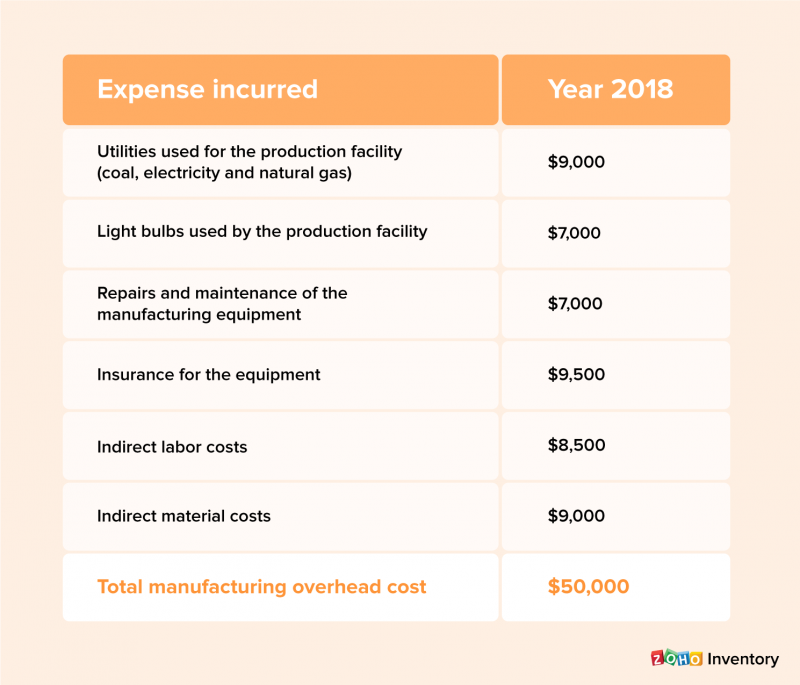

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

The predetermined overhead rate is an estimation of overhead costs applicable to work in progress inventory during the accounting period.

. Machining Direct labor-hours 120 Machine-hours 60 Direct material cost 350 Direct labor cost 350 Assembly Direct labor-hours 75 Machine-hours 5 Direct material cost 100 Direct labor cost450. Companies using this method will apply overhead to either the number of machine hours used or the direct labor hours which were consumed. Direct labor cost 750000 Manufacturing overhead costs 210000 The accounting records of the company show the following data for Job 316.

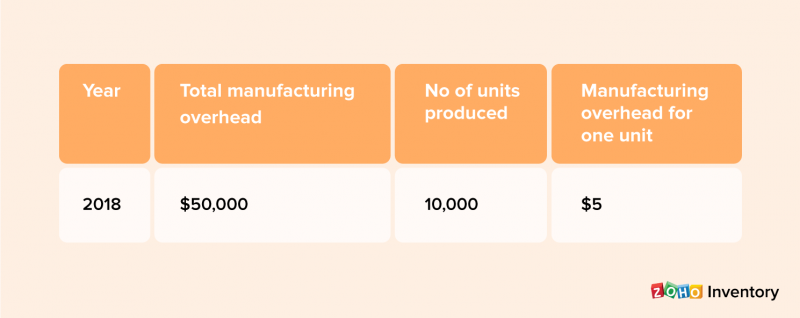

This is calculated by dividing the estimated manufacturing overhead costs by the allocation base or estimated volume of production in terms of labor hours labor cost machine hours or materials. The traditional costing system in accounting is the allocation of factory overhead to products which is based on the volume of consumed production resources.

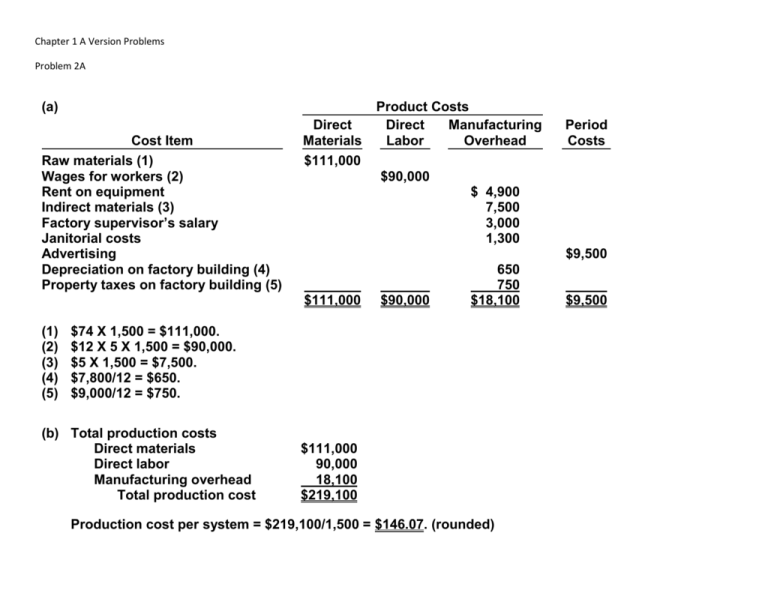

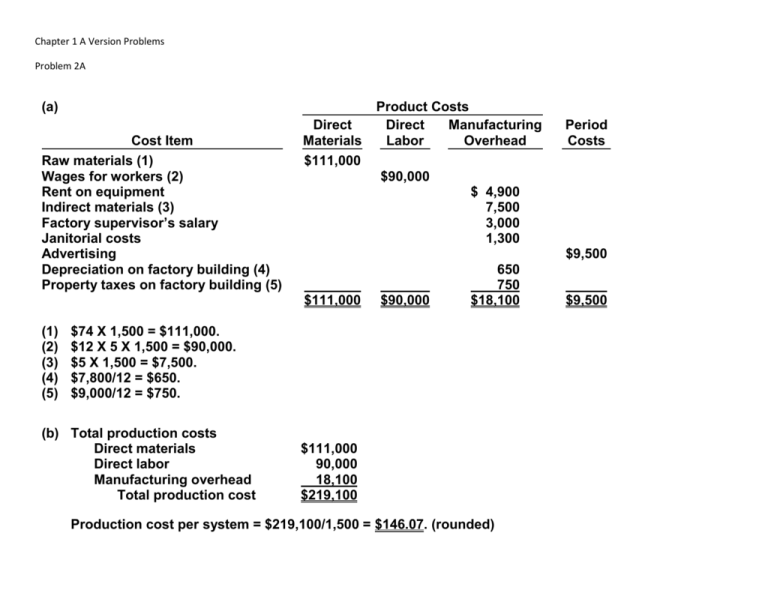

A Product Costs Cost Item Direct Materials Direct Labor

No comments for "Factory Overhead Is 75 of the Cost of Direct Labor"

Post a Comment